April 2023

Publication of Framework Agreement for Teleworkers as of 1 July 2023

Summary

Further to our last update regarding the future of telework within the EU, the official text of the Framework Agreement for Telework has now been published.

It has become clear under which conditions employees can continue social security coverage in the country of their employer whilst Teleworking in their home country:

- working time in the home country should be less than 50%;

- it applies to employees only;

- who are employed with an employer in another Member State;

- who only habitually work in the country of employer and telework in their home country;

- both countries (home and employer country) will need to apply the Framework Agreement;

- an A1-statement is required.

The required A1-statement will be issued by the Member State where the employer is located for a period up to 3 years and extension of the A1-statement for teleworking is possible. Also, it should be noted that strict timelines will apply per July 2024 for the teleworking A1-statement to have retroactive effect.

We are now awaiting publication of the Member States that will apply the Agreement. We will keep you posted on that.

Key recommendations

- Identify your population of cross-border teleworkers; who can fall under the scope of this Agreement?

- Check your policies; are they aligned with this new Framework Agreement?

- Communicate to your employees on the new possibilities and limitations to work from home.

- Apply for (or adjust existing) A1-certificates for your employees concerned and keep the (future) application deadlines in mind.

The Detail

As a quick recap, as of 1 July 2023, the social security relaxation measures for working from home are no longer applicable. There will be no extension, however the Administrative Commission prepared a Framework Agreement for Telework for the period as of 1 July 2023. This agreement entails that Member States agree to deviate from the main rules as included in the EU-Regulation for social security if a situation meets the criteria.

Scope

The Framework Agreement applies to cases where both the home country and the country where the employer is located have signed the Agreement. It is currently not yet clear which countries will apply the Agreement, but this will be a first important check to determine whether these exception rules apply.

Furthermore, the Agreement covers persons who would fall under the home country social security scheme, based on the multi-state rules of the EU-Regulation, as a result of performing cross-border telework on a structural basis for one or more EU-employers.

The term “cross-border telework” is (shortly put) defined as an activity that can be pursued from any location, carried out in a Member State / States other than the one in which the employer is located and is based on information technology to remain connected to the employer’s or business environment. In practice this means that an employee can work in their home country from different locations (and not only from home) as long as they work via ‘information technology’ for their employer who is suited in another member state.

Please note that the following situations are specifically excluded from application of the Agreement:

- Individuals who habitually perform other activities than cross-border telework in the home country;

- Individuals who habitually perform an activity outside the home country or the employer country;

- Self-employed individuals.

Example

An employee is living in Belgium and employed by a Dutch entity. The employee works 40% from home in Belgium and 60% in the Netherlands. Assuming that both the Dutch and Belgian authorities apply the Agreement, the employee would fall under the Framework Agreement and can apply for an A1-statement to continue social security in the Netherlands.

In case the employee also habitually visits clients in Belgium or partly works on behalf of the entity in Belgium, the criteria of the Agreement will not be met.

Should the employee work 40% from home in Belgium, 40% in the Netherlands and 20% in Germany, the criteria of the Agreement will also not be met as the employee works habitually outside the home country and the employer country.

In cases where the Framework Agreement is not applicable, the regular multi-state rules apply on the case at hand. In those cases, it should be considered whether the individual performs less than 25% of the work in the home country, otherwise the social security scheme of the employer country will apply.

Applicable legislation

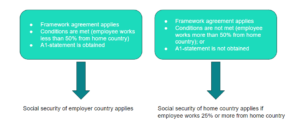

If the Framework Agreement applies, an employee can apply for an A1-statement to be covered by the social security scheme of the country where their employer is suited in case the cross-border telework in the home country is less than 50% of the total work time.

If the employee works more than 50% from the home country, the social security scheme of the home country will apply which may result in a shift of social security. Also, it should be carefully noted that without an A1-statement in place, the standard rules for working in multiple countries apply. In that case, employees working 25% of their time or more from their home country, will be covered by the social security scheme of their home country.

Procedure

As a starting point, the main rules from the EU-Regulation apply to multi-state workers. However, in case the criteria of the Framework Agreement are met, employee and employer can opt-in and apply the deviating rules from the Agreement. This opt-in takes place by applying for an A1-statement in the country where the employer is located. Without an A1-statement on the basis of this Agreement, the reference rules from the EU-Regulation are applicable (25% threshold).

Certain time limits have to be considered when retroactively applying for an A1 based on the Agreement:

- For the first 12 months (1 July 2023 – 30 June 2024), an A1 can be applied for with retroactive effect as of 1 July 2023, as long as the criteria of the Agreement are met;

- After this 12 month period (per 1 July 2024), an A1 can only be applied for retroactively in case the application is submitted within 3 months;

- In both scenario’s social security contributions must have been paid in the employer country in the period for which a retroactive A1 is applied for.

The employer country can grant the A1-statement based on Article 16 (no mutual agreement with the home country needed). These A1’s can be applied for a maximum of 3 years at a time and can be extended each time (given that the criteria of the Agreement continue to be met).

How we can help

To make sure you meet your compliance and contribution obligations, it is important that you apply the conditions of the new Agreement correctly. Vialto Partners can help you identify the employees that may fall under this Agreement and how the Agreement may impact their social security position.

In addition, currently, it is not clear yet which Member States will be part of the Framework Agreement. Therefore a country-by-country approach would be needed. Vialto Partners can help you understand exactly which changes will take place in the country-by-country constellations that your business operates in and implement these challenges in your policies and processes.

We are assisting large and small businesses across the EU/EEA in designing commuter policies and guidelines for Working-From-Home arrangements. We will be happy to leverage this experience to assist you in designing your policies, which are tailored to your company, business, and industry needs.

Contact us

Please feel free to reach out your local social security contact at Vialto Partners or to the Vialto Partners Social Security Leadership team:

- Adam Rewucha and Wendy Toonen, Northern European Social Security Leads

- Natalia Graf and Morgane Texier, Western and Southern European Social Security Leads

- Barbara Kolimeczkow, Eastern European Social Security Lead

- Gary Chandler, UK/Ireland Social Security Lead

Further information on Vialto Partners can be found here: www.vialtopartners.com

Vialto Partners (“Vialto”) refers to wholly owned subsidiaries of CD&R Galaxy UK OpCo Limited as well as the other members of the Vialto Partners global network. The information contained in this document is for general guidance on matters of interest only. Vialto is not responsible for any errors or omissions, or for the results obtained from the use of this information. All information is provided “as is”, with no guarantee of completeness, accuracy, timeliness or of the results obtained from the use of this information, and without warranty of any kind, express or implied, including, but not limited to warranties of performance, merchantability and fitness for a particular purpose. In no event will Vialto, its related entities, or the agents or employees thereof be liable to you or anyone else for any decision made or action taken in reliance on the information in this document or for any consequential, special or similar damages, even if advised of the possibility of such damages.

Want to know when a Regional Alert is posted?

Simply follow our Vialto Alerts page on LinkedIn and posts will be displayed on your feed. To ensure you don’t miss one, once you’re on our LinkedIn page, click on the bell icon under the banner image to manage your notifications.

Further information on Vialto Partners can be found here: www.vialtopartners.com

Vialto Partners (“Vialto”) refers to wholly owned subsidiaries of CD&R Galaxy UK OpCo Limited as well as the other members of the Vialto Partners global network. The information contained in this document is for general guidance on matters of interest only. Vialto is not responsible for any errors or omissions, or for the results obtained from the use of this information. All information is provided “as is”, with no guarantee of completeness, accuracy, timeliness or of the results obtained from the use of this information, and without warranty of any kind, express or implied, including, but not limited to warranties of performance, merchantability and fitness for a particular purpose. In no event will Vialto, its related entities, or the agents or employees thereof be liable to you or anyone else for any decision made or action taken in reliance on the information in this document or for any consequential, special or similar damages, even if advised of the possibility of such damages.

© 2025 Vialto Partners. All rights reserved.