Social Security

EU | Update Framework Agreement for Teleworkers – Country Overview

Summary

As of 1 July 2023 the Framework Agreement for Telework will come into place. Based on this agreement cross-border teleworkers within the EU can work from home up to (not including) 50% of their working time before shifting social security coverage to their home country. A great solution for companies with cross-border employees to facilitate working from home cross border and seek alignment with their domestic working from home policies. However, the Framework Agreement will not be applicable all over the EU, EEA and Switzerland, since Member States actively need to opt-in to participate in the agreement.

It has been announced that the following countries will apply the Agreement per 1 July 2023: Austria, Belgium, Croatia, Czech Republic, Estonia, France, Finland, Germany, Ireland, Liechtenstein, Lithuania, Luxembourg, Malta, Netherlands, Norway, Poland, Portugal, Spain, Slovakia, Sweden and Switzerland. However, the list of countries who have signed the Agreement is still subject to change.The official list can be found here.

More details on the content of the Framework Agreement and the exact conditions for Teleworkers to be able to benefit from the Framework Agreement can be found in this Newsflash.

Key recommendations

Now the Framework Agreement enters into force, we recommend you to take the following steps:

- Identify your population of cross-border teleworkers; who can fall under the scope of this Agreement?

- Reconsider your policies; what approach to take considering that depending on the country combination different thresholds may apply?

- Consider your governance and how this can best be monitored.

- Communicate to your employees on the new possibilities and limitations to work from home. Important to note: the Framework Agreement gives the employer and employee an option, it is not an obligation. Both employer and employee need to agree to apply the Agreement.

- Apply for (or adjust existing) A1-certificates for your employees concerned and keep future application deadlines in mind.

The Detail

As of 1 July 2023 the Framework Agreement for Telework will enter into force. This agreement entails that Member States agree to deviate from the main rules as included in the EU-Regulation for social security if a situation meets certain criteria. Under the Framework Agreement for Teleworkers, a cross-border teleworker can continue coverage in the employer country when combining working in the employer country with less than 50% teleworking from their residency country.

Cross-border telework is defined as an activity that can be pursued from any location, carried out in a Member State other than the one in which the employer is vested and is based on information technology to remain connected to the employer’s or business environment. In practice this means that an employee can work in their home country from different locations (and not only from home) as long as they work via ‘information technology’ for their employer who is vested in another Member State.

The Framework Agreement for Telework will not be applied by all EU/EEA countries. Thus far only a number of Member States have actually signed the Framework Agreement, while others have notified Belgium (as the depository state) that they have the intention to sign or will not sign, and others have not officially announced their position.

| Signed | Confirmed but not signed | No official position | Will not sign |

| Austria | Estonia | Bulgaria | United Kingdom |

| Belgium | Cyprus | Denmark | |

| Croatia | Greece | ||

| Czech Republic | Hungary | Iceland | |

| Finland | Latvia | ||

| France | Romania | ||

| Germany | |||

| Liechtenstein | |||

| Luxembourg | |||

| Malta | |||

| Netherlands | |||

| Norway | |||

| Poland | |||

| Portugal | |||

| Spain | |||

| Slovakia | |||

| Sweden | |||

| Switzerland | |||

| Italy (applicable as of 1 January 2024). | |||

| Slovenia (applicable as of 1 September 2023) | |||

| Lithuania (applicable as of 1 May 2024) | |||

| Ireland (applicable as of 1 June 2024) |

*Overview on 3 July 2023

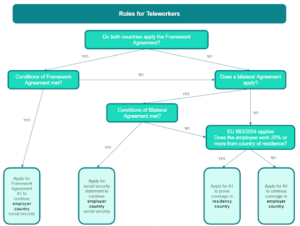

Which social security rules will apply for teleworkers as of 1 July 2023 will therefore depend on the residency country and employer country of the employee. We have summarised the possible outcomes in the overview on the next page.

* Indicative overview of various outcomes for determining the social security position of cross-border Teleworkers within the EU, EEA and Switzerland.

Bilateral telework agreements

Certain countries have signed bilateral agreements for teleworkers which allow employees to continue employer country coverage while teleworking up to a certain percentage (for example, Austria and Germany for working up to 40% in the home country). If the Framework Agreement is not applicable, such bilateral agreement for telework may provide a possibility to continue the social security coverage in the employer country while working 25% or more in the residency country.

For example, Denmark and Sweden have concluded a bilateral agreement for telework where an employee can work up to 50% in the residency country while remaining covered in the employer country. Those countries do not apply the Framework Agreement but have separate agreements in place for teleworkers. We refer to our earlier update for an overview of such regional solutions (March 2023).

A1 Required and applied for in employer country

If the conditions are met and both employer and employee agree to apply the Framework Agreement, it is required to apply for an A1 document confirming the social security position. This A1 document should be applied for in the country where the employer is vested (and whose social security scheme will apply). Member States are currently working on updating their application processes for these A1 applications.

Please note that strict deadlines will apply for the Telework A1-applications as from 2024. For more information, we refer to our earlier Newsflash.

Good to know: is the teleworker working less than 25% in the country of residence, an A1 document based on the regular multi-state rules should be applied for in the country of residence (and not in the country where the employer is vested).

How we can help

To make sure you meet your compliance and contribution obligations, it is important that you apply the conditions of the new Agreement correctly. And since not all countries apply the Framework Agreement, a country-by-country approach would be needed. Vialto Partners can help you identify the employees who may fall under this Agreement and how the Agreement may impact their social security position. Where applicable, we can apply for the A1-statements required.

We are assisting large and small businesses across the EU/EEA in designing commuter policies and guidelines for Working-From-Home arrangements. We will be happy to leverage this experience to assist you in designing your policies, which are tailored to your company, business, and industry needs.

Contact us

Please feel free to reach out your local social security contact at Vialto Partners or to the Vialto Partners Social Security Leadership team:

Adam Rewucha and Wendy Toonen

Northern European Social Security Leads

Natalia Graf and Morgane Texier

Western and Southern European Social Security Leads

Barbara Kolimeczkow

Eastern European Social Security Lead

Gary Chandler

UK/Ireland Social Security Lead

Vialto Partners (“Vialto”) refers to wholly owned subsidiaries of CD&R Galaxy UK OpCo Limited as well as the other members of the Vialto Partners global network. The information contained in this document is for general guidance on matters of interest only. Vialto is not responsible for any errors or omissions, or for the results obtained from the use of this information. All information is provided “as is”, with no guarantee of completeness, accuracy, timeliness or of the results obtained from the use of this information, and without warranty of any kind, express or implied, including, but not limited to warranties of performance, merchantability and fitness for a particular purpose. In no event will Vialto, its related entities, or the agents or employees thereof be liable to you or anyone else for any decision made or action taken in reliance on the information in this document or for any consequential, special or similar damages, even if advised of the possibility of such damages.

Further information on Vialto Partners can be found on our website: www.vialtopartners.com

© 2024 Vialto Partners. All rights reserved.