Mapping the landscape of global employment tax

In our increasingly global workforce, gone are the days of simply providing a salary and applying a percentage to capture the payroll withholding due. With new workforce models and a growing demand for remote workers—employment tax management has never been more important. Navigating complex tax laws and compensation is increasingly difficult, but innovative solutions are emerging to make it less complicated.

As of 2019, the average personal income tax and social security contributions comprised 49% of the total tax yield across OECD countries. Organizations face increased pressure from government authorities to collect those taxes in tandem with continuous reporting on salaries, benefits and equity payments. With access to significant data to verify the accuracy of that tax collection, this brings cost and risk for any organization with domestic and/or global workforces.

Global trends in taxation

Getting ahead of trends in taxation, robust governance and oversight when it concerns employment taxes has never been more invaluable. Responding to shareholder and stakeholder interests, organizations have emphasized transparency when publishing the information relating to the employment taxes withheld and paid to tax authorities.

The practice of tax transparency took off during the 2008 financial crash and continues with recent ESG trends and government regulations. This transparency not only shows the significant cost to an organization but also the total value of risk being managed by teams responsible for employment taxes.

“The growth of dedicated in-house global employment tax teams demonstrates an increased focus by organizations on employer compliance and risk. Yet, implementing a global employment tax solution is not one-size-fits-all; complex tax regimes and country and regional differences with differing risk profiles means prioritization and flexibility is key in managing employment tax,” said Sean Drury, a partner in Vialto’s London office. “That’s why we help organizations find a pathway through these challenges to support the specific needs of each organization that is grounded in our technical and practical experience.”

The Vialto Partners perspective

Vialto Partners has a global team of employment tax specialists supporting both multinational and domestic clients. Our global employment tax team covers the Americas, EMEA and APAC and gives you access to local experts to help you navigate country and regional differences.

We also have experience working as part of in-house employment tax teams—embedding strategy, governance and stakeholder engagement expertise to meet employer reporting and compliance obligations. Working together with our clients, we craft tailored solutions and make implementation seamless with our integrated, API-driven technology platform.

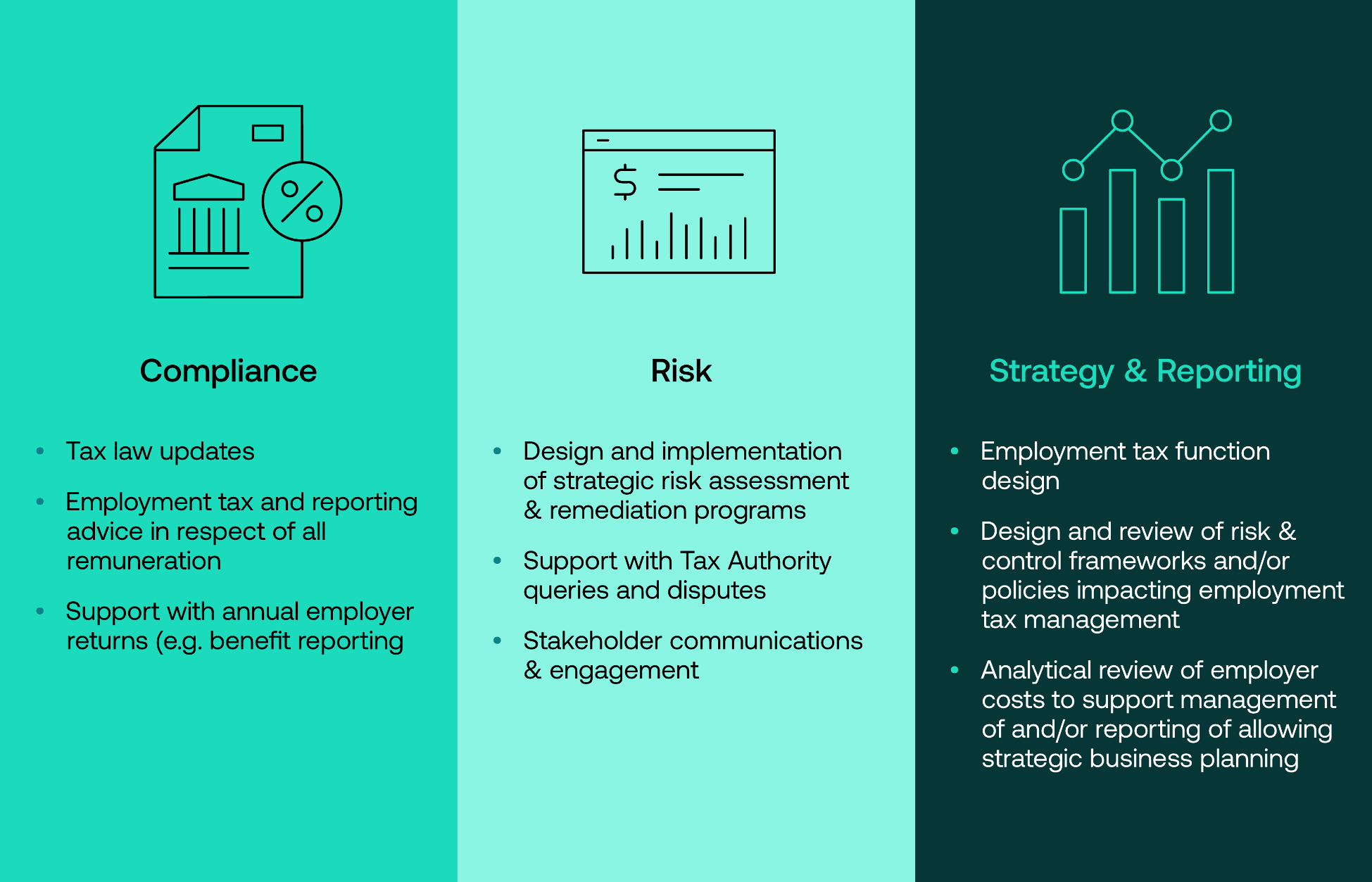

Global employment tax solutions at a glance

Let's connect

Please reach out if you’d like to learn more about Vialto.